This Analyst Is ‘Dramatically’ Souring on AI Stock. Should You Sell C3.ai Here?

/AI%20(artificial%20intelligence)/Artificial%20intelligence%20and%20machine%20learning%20concept%20-%20by%20amgun%20via%20iStock.jpg)

C3.ai (AI) stock plummeted 26% last Monday after the enterprise artificial intelligence (AI) company delivered shocking preliminary results that prompted Oppenheimer to slash its rating and estimates. C3.ai expects Q1 fiscal 2026 revenue of just $70.2-70.4 million, a 33% drop from prior guidance and 19% decline from last year's $87.2 million. Oppenheimer analyst Timothy Horan downgraded the tech stock to “Perform” from “Outperform,” removing his $45 price target entirely.

"We are concerned that these results indicate secular weakness in underlying trends," Horan warned, citing the 35% sequential revenue decline as particularly troubling given C3.ai's subscription-based model. The firm slashed full-year revenue estimates to $291 million from $464 million.

CEO Thomas Siebel attributed the dismal performance to sales reorganization disruption and his health issues. Siebel admitted his reduced participation in sales processes had greater impact than anticipated and announced a CEO search is underway.

The company's GAAP operating loss widened to $124.7-124.9 million from $72.59 million last year, while non-GAAP operating losses doubled to $58 million from $29 million expected.

With C3.ai restructuring its entire sales organization and facing a leadership transition, the risk-reward profile has shifted notably. While Siebel claims his health has "improved dramatically" and the AI stock is "positioned to accelerate," investors should await the Sept. 3 earnings call for clarity on whether this represents a temporary disruption or a fundamental deterioration in the AI software market.

A Strong Performance in Fiscal 2025

The revenue miss comes just months after C3.ai delivered what appeared to be strong momentum in fiscal 2025. During its fourth-quarter earnings call in May, Siebel had struck an optimistic tone. The CEO then highlighted 26% revenue growth and celebrated what he called a "spectacular" year that saw C3.ai’s growth trajectory accelerate from 6% two years ago to 25% in fiscal 2025.

In May, C3.ai reported fourth-quarter revenue of $108.7 million, with total fiscal 2025 revenue reaching $389.1 million. Siebel had emphasized an expanding partner ecosystem, including strategic alliances with Microsoft (MSFT) Azure, AWS (AMZN), and Google Cloud (GOOG)(GOOGL), which he claimed gave C3.ai access to tens of thousands of sales representatives across these platforms.

The CEO had also touted the renewal and expansion of the critical Baker Hughes (BKR) partnership through 2028, calling it a relationship that had generated over $500 million in revenue for C3.ai. He expressed confidence about the company's diversification beyond oil and gas, noting 48% growth in non-oil and gas revenue and expansion across 19 different industries.

C3.ai ended fiscal 2025 with $750 million in cash and was forecast to report an adjusted net income within the next 18 months. The preliminary Q1 results suggest that Siebel's optimism may have been premature, raising questions about whether the partner-driven strategy and diversification efforts are translating into sustainable revenue growth.

Is C3.ai Stock Overvalued Right Now?

Analysts tracking the AI stock forecast sales to increase from $389 million in fiscal 2025 to $613.6 million in fiscal 2028. C3.ai is expected to end fiscal 2028 with a free cash flow of $50.88 million, compared to an outflow of $45 million in 2025.

Today, C3.ai stock is priced at 5.6x forward sales, which is below its average multiple of 13x. If the AI stock is priced at 5x forward sales, it could gain over 35% over the next two years.

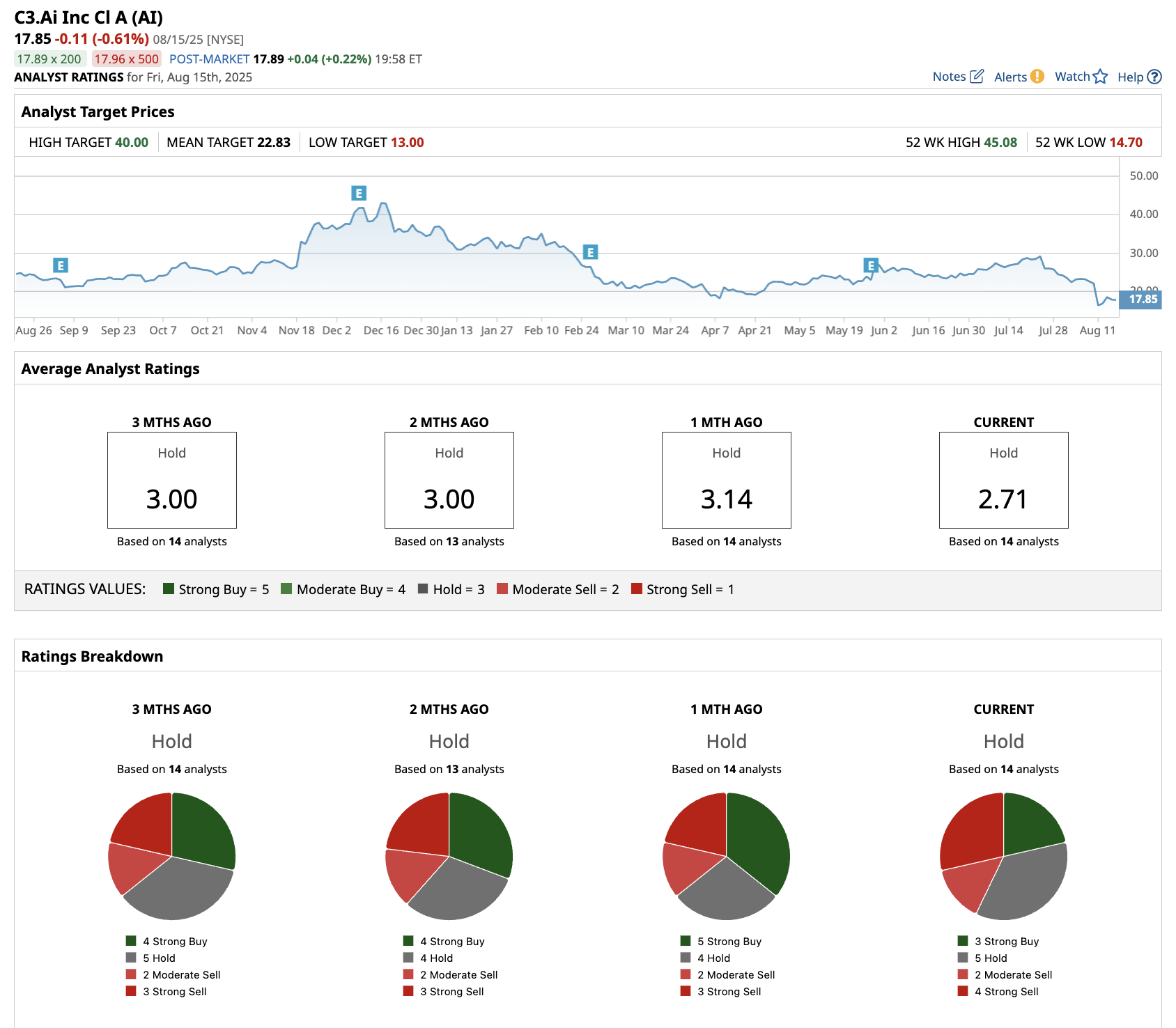

Out of the 14 analysts covering AI stock, three recommend “Strong Buy,” five recommend “Hold,” two recommend “Moderate Sell,” and four recommend “Strong Sell.” The average target price for AI stock is $22.83, above the current price of $17.85.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.