GE Vernova Stock: Is GEV Outperforming the Industrials Sector?

With a market cap of $163.4 billion, GE Vernova Inc. (GEV) is a global energy company, focused on generating, transferring, converting, storing, and orchestrating electricity. Operating through its Power, Wind, and Electrification segments, the company delivers technologies spanning gas, nuclear, hydro, steam, wind, solar, storage, and grid solutions.

Companies valued at more than $10 billion are generally considered “large-cap” stocks, and GE Vernova fits this criterion perfectly. GE Vernova combines advanced research, consulting, and financial services to accelerate the energy transition worldwide.

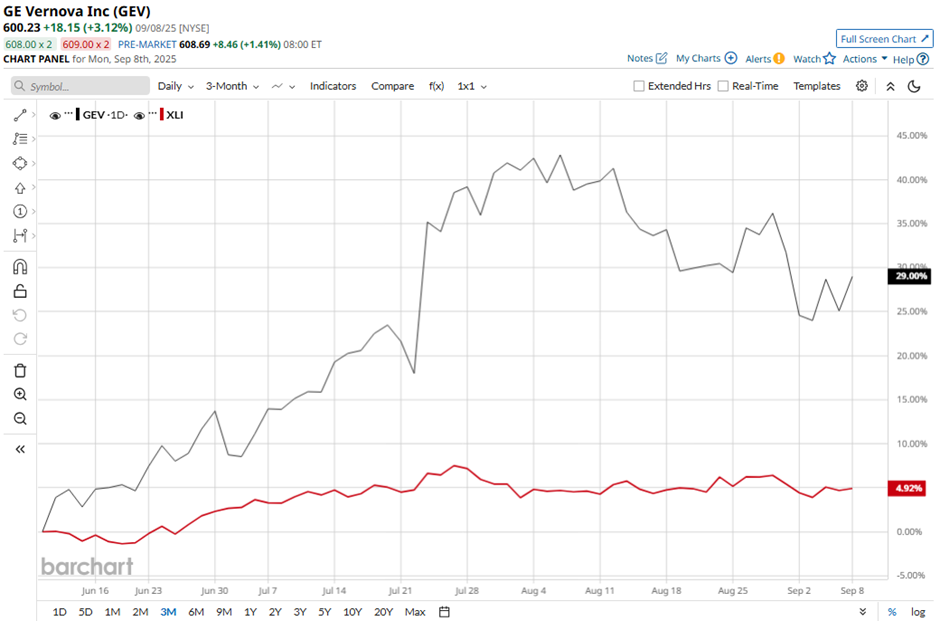

Shares of the Cambridge, Massachusetts-based company have decreased 11.4% from its 52-week high of $677.29. GE Vernova’s shares have increased 23.8% over the past three months, outperforming the Industrial Select Sector SPDR Fund’s (XLI) 4.4% gain over the same time frame.

In the longer term, GEV stock is up 82.5% on a YTD basis, significantly outpacing XLI’s 14.8% return. In addition, shares of the power equipment maker have soared 202.6% over the past 52 weeks, compared to XLI’s 20.2% return over the same time frame.

Despite a few fluctuations, the stock has been trading above its 50-day and 200-day moving averages since last year.

Shares of GE Vernova surged 14.6% on Jul. 23 after the company posted stronger-than-expected Q2 results, with profit of $1.86 and revenue of $9.1 billion. The company also raised its full-year free cash flow forecast to $3 billion - $3.5 billion, a more than 44% increase at the midpoint, and guided 2025 revenue toward the high end of $36 billion - $37 billion. Strong performances from its Power unit, with profit up 27% to $778 million, and its Electrification unit, with profit more than doubling to $332 million, further fueled investor optimism.

Moreover, GEV stock has significantly outperformed its rival Honeywell International Inc. (HON). Shares of Honeywell have dipped 4.9% on a YTD basis and risen 8.4% over the past 52 weeks.

Despite the stock’s strong performance, analysts remain cautiously optimistic about its prospects. The stock has a consensus rating of “Moderate Buy” from 28 analysts' coverage, and the mean price target of $660.21 is a premium of nearly 10% to current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.