What You Need To Know Ahead of Chipotle Mexican Grill's Earnings Release

/Chipotle%20Mexican%20Grill%20storefront%20by-%20Anne%20Czichos%20via%20Shutterstock.jpg)

Newport Beach, California-based Chipotle Mexican Grill, Inc. (CMG) operates quick-casual and fresh Mexican food restaurant chains. Its offerings include burritos, quesadillas, tacos, salads, and more. With a market cap of $54.9 billion, Chipotle’s operations span the U.S., Canada, France, Germany, Dubai, and the U.K.

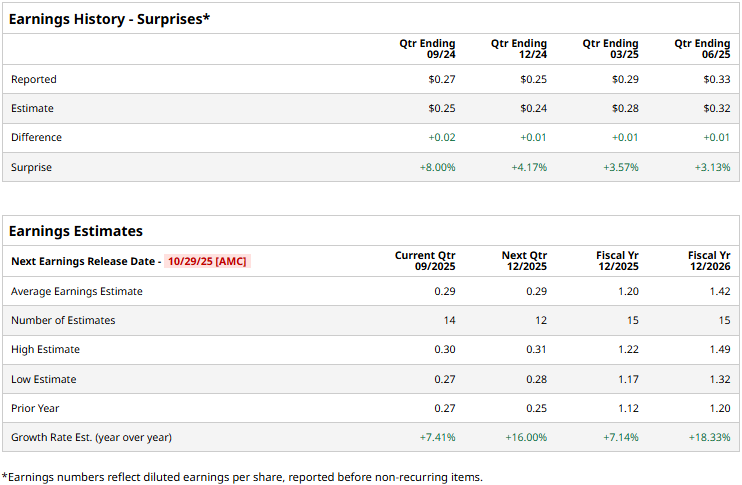

The restaurant giant is gearing up to announce its third-quarter results after the markets close on Wednesday, Oct. 29. Ahead of the event, analysts expect CMG to deliver an EPS of $0.29, up 7.4% from $0.27 reported in the year-ago quarter. Moreover, the company has a solid earnings surprise history. Chipotle has surpassed the Street’s bottom-line estimates in each of the past four quarters.

For the full fiscal 2025, analysts expect CMG to deliver earnings of $1.20 per share, up 7.1% from $1.12 reported in 2024. While in fiscal 2026, its earnings are expected to surge 18.3% year-over-year to $1.42 per share.

CMG stock prices have plummeted 29.3% over the past 52 weeks, notably underperforming the Consumer Discretionary Select Sector SPDR Fund’s (XLY) 20% surge and the S&P 500 Index’s ($SPX) 17.4% gains during the same time frame.

Chipotle’s stock prices plunged 13.3% in a single trading session after the release of its lackluster Q2 results on Jul. 23. During the quarter, Chipotle opened 61 company-owned restaurants, with 47 locations including a Chipotlane. This increased its overall revenues by 3% year-over-year to $3.1 billion, which fell 1.2% below the Street’s expectations.

Chipotle’s comparable restaurant sales during the quarter dropped by 4% year-over-year due to a 4.9% decline in transactions, partially offset by an increase in average check. Further, its restaurant-level operating margins contracted by 1.5% to 27.4%, unsettling investor confidence. Meanwhile, its adjusted EPS dipped 2.9% year-over-year to $0.33.

Nevertheless, the consensus view on CMG remains highly optimistic, with a “Strong Buy” rating overall. Of the 32 analysts covering the stock, opinions include 22 “Strong Buys,” three “Moderate Buys,” and seven “Holds.” Its mean price target of $58.13 suggests a 41.8% upside potential from current price levels.

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.