GE HealthCare Technologies Earnings Preview: What to Expect

/GE%20HealthCare%20Technologies%20Inc%20logo%20on%20phone%20and%20site-by%20T_Schneider%20via%20Shutterstock.jpg)

Chicago, Illinois GE HealthCare Technologies Inc. (GEHC) designs medical imaging and patient-monitoring products and related equipment and services. Valued at $34 billion by market cap, GEHC has a leading market share in imaging and ultrasound equipment. The company is set to announce its third-quarter results before the market opens on Wednesday, Oct. 29.

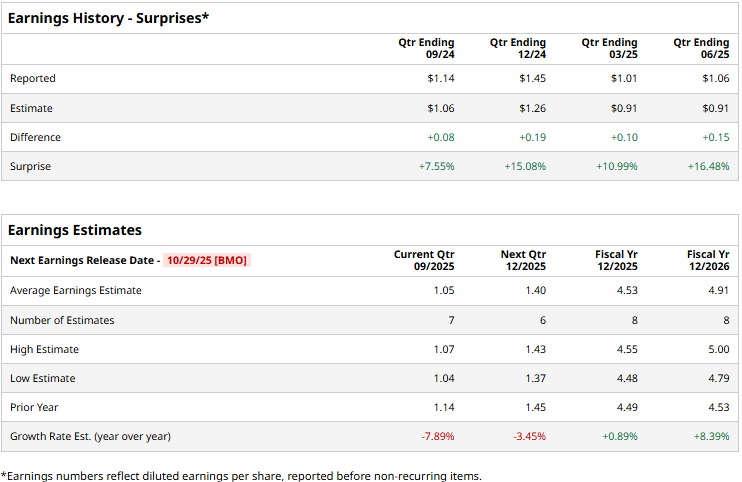

Ahead of the event, analysts expect the healthcare major to deliver a profit of $1.05 per share, down 7.9% from $1.14 per share reported in the year-ago quarter. On the positive note, the company has a solid earnings surprise history. It has surpassed the Street’s bottom-line estimates in each of the past four quarters.

For the full fiscal 2025, GEHC is expected to report an EPS of $4.53, up 89 bps from $4.49 reported in fiscal 2024. While in fiscal 2026, its earnings are expected to soar 8.4% year-over-year to $4.91 per share.

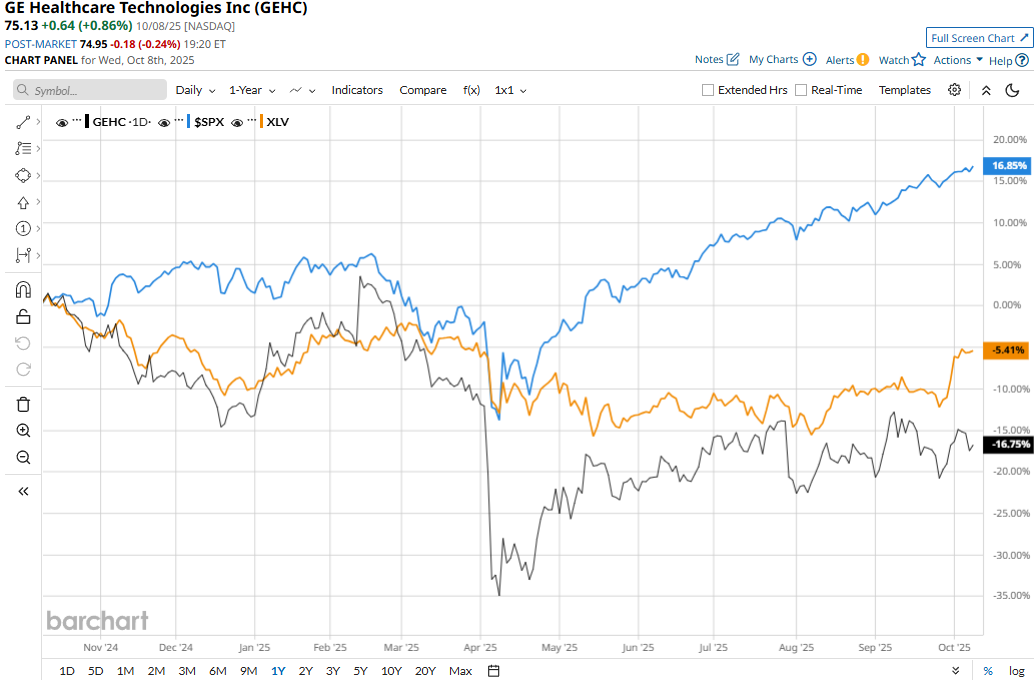

GEHC stock prices have declined 17.2% over the past 52 weeks, notably underperforming the Health Care Select Sector SPDR Fund’s (XLV) 4.8% dip and the S&P 500 Index’s ($SPX) 17.4% gains during the same time frame.

Despite reporting better-than-expected earnings and topline, GE HealthCare’s stock prices dropped 7.8% in the trading session following the release of its Q2 results on Jul. 30. Driven by high levels of customer investment in capital equipment, the company’s total revenues for the quarter grew 3.5% year-over-year to $5 billion, exceeding the Street’s expectations by 66 bps. Further, driven by a notable dip in operating expenses, the company’s net income surged 13.6% year-over-year to $486 million, and its EPS of $1.06 surpassed the consensus estimates by 16.5%.

However, GEHC’s 2025 margins are expected to remain under pressure due to high tariffs imposed by the current Federal government on the EU and other Indo-Pacific nations.

The consensus view on GEHC has deteriorated recently, dropping to a “Moderate Buy” rating. Of the 20 analysts covering the stock, opinions include 12 “Strong Buys,” one “Moderate Buy,” and seven “Holds.” Its mean price target of $87.31 suggests a modest 16.2% upside potential from current price levels.

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.