What to Expect From Coinbase Global's Q3 2025 Earnings Report

Valued at $96.6 billion by market cap, New York-based Coinbase Global, Inc. (COIN) operates the world’s largest crypto trading platform with operations spanning North America and internationally. It offers the primary financial account in the crypto economy for consumers; a brokerage platform with a pool of liquidity across the crypto marketplace for institutions; and a suite of products granting access to build onchain for developers.

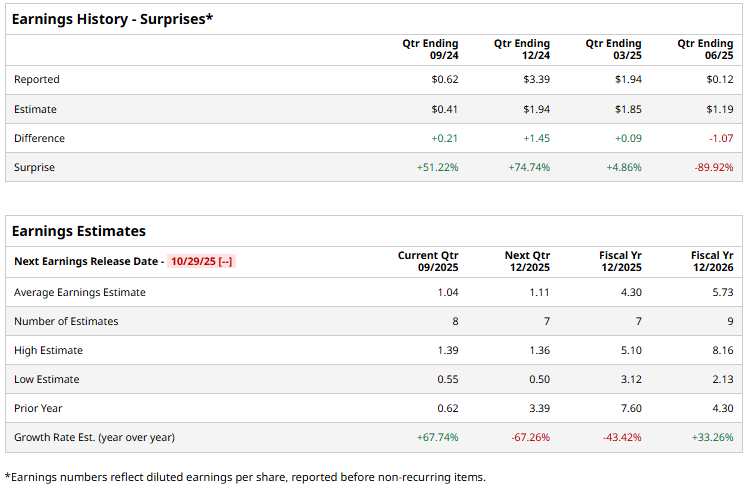

The crypto giant is expected to announce its third-quarter results by the end of this month. Ahead of this event, analysts expect COIN to deliver an adjusted profit of $1.04 per share, up a massive 67.7% from $0.62 per share reported in the year-ago quarter. While the company has missed the Street’s bottom-line estimates once over the past four quarters, it has surpassed the projections on three other occasions.

For the full fiscal 2025, its earnings are expected to come in at $4.30 per share, down 43.4% from $7.60 per share in 2024. While in fiscal 2026, its earnings are expected to grow 33.3% year-over-year to $5.73 per share.

COIN stock prices have soared 130.9% over the past 52 weeks, notably outperforming the Financial Select Sector SPDR Fund’s (XLF) 18% surge and the S&P 500 Index’s ($SPX) 17.4% gains during the same time frame.

Coinbase’s stock prices plunged 16.7% in a single trading session following the release of its lackluster Q2 results on Jul. 31. Driven by a massive drop in consumer and institutional trading volumes compared to Q1 2025, the company’s total transaction revenues dropped 39.5% quarter-on-quarter and 2.1% year-on-year to $764.3 million. Overall, its net revenues inched up 3.3% year-over-year to $1.5 billion, missing the consensus estimates by 49 bps. Meanwhile, its adjusted net income plummeted 88.7% year-over-year to $33.2 million, and its adjusted EPS of $0.12 fell 89.9% below the Street’s expectations, unsettling investor confidence.

The consensus view on COIN remains cautiously optimistic, with a “Moderate Buy” rating overall. Of the 33 analysts covering the stock, opinions include 15 “Strong Buys,” one “Moderate Buy,” 14 “Holds,” and three “Strong Sells.” As of writing, the stock is trading above its mean price target of $381.22.

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.