Earnings Preview: What To Expect From PayPal Holdings’ Report

/PayPal%20Holdings%20Inc%20logo%20and%20money-by%20Sergio%20Photone%20via%20Shutterstock.jpg)

Valued at $71.3 billion by market cap, PayPal Holdings, Inc. (PYPL) has been a pioneer of the fintech industry for over two decades. While the San Jose-based fintech giant’s payment solutions serve people from diverse demographics, its mobile payment service Venmo has gained significant traction among the younger generations in recent years.

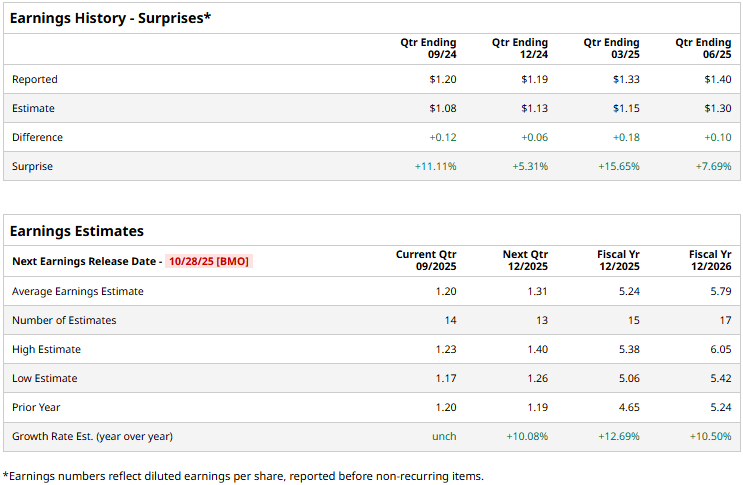

The payments processor is set to unveil its third-quarter results before the markets open on Tuesday, Oct. 28. Ahead of the event, analysts expect PYPL to report an adjusted EPS of $1.20, remaining flat year-over-year. On a more positive note, the company has a solid earnings surprise history. It has surpassed the Street’s bottom-line estimates in each of the past four quarters.

For the full fiscal 2025, PayPal’s adjusted EPS is expected to come in at $5.24, up 12.7% from $4.65 in fiscal 2024. While in fiscal 2026, its earnings are expected to surge 10.5% year-over-year to $5.79 per share.

PayPal’s stock prices have declined 6.2% over the past 52 weeks, notably underperforming the Financial Select Sector SPDR Fund’s (XLF) 18% surge and the S&P 500 Index’s ($SPX) 17.4% gains during the same time frame.

PayPal’s stock prices plunged 8.7% in the trading session after the release of its Q2 results on Jul. 29. The company’s revenues for the quarter increased 5% year-over-year to $8.3 billion, beating the consensus estimates by a large margin. Further, its non-GAAP EPS increased 18% year-over-year to $1.40, exceeding the Street’s expectations by 7.7%. However, this profitability improvement was based on margins. The number of payment transactions done through PayPal’s platform dropped 5.4% year-over-year to 6.2 billion, which unsettled investor confidence.

The consensus view on PYPL is cautiously optimistic, with a “Moderate Buy” rating overall. Of the 41 analysts covering the stock, opinions include 12 “Strong Buys,” two “Moderate Buys,” 24 “Holds,” and three “Strong Sells.” Its mean price target of $80.66 suggests a modest 6% upside potential from current price levels.

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.