Baker Hughes’ Q3 2025 Earnings: What to Expect

Valued at a market cap of $47.9 billion, Baker Hughes Company (BKR) is a leading global energy technology firm that provides solutions for the oil and gas industry as well as emerging clean energy sectors. The company, based in Houston, Texas, operates through two main segments: Oilfield Services & Equipment (OFSE), which delivers drilling, evaluation, and production services, and Industrial & Energy Technology (IET), which offers gas turbines, compressors, and digital solutions for energy efficiency and decarbonization.

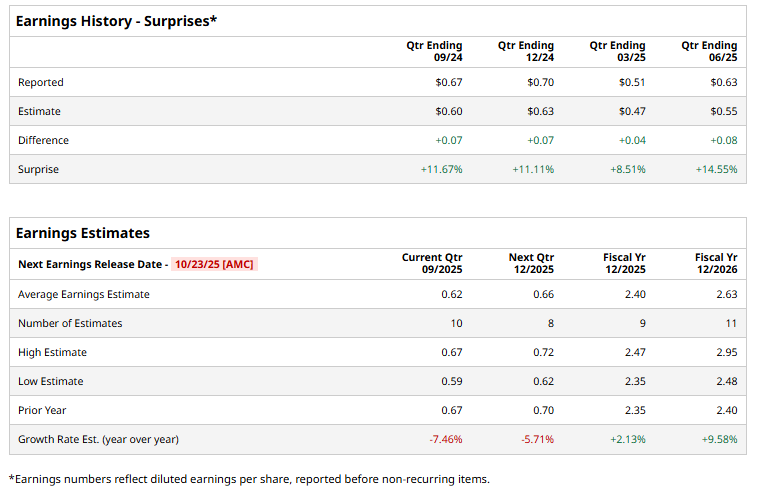

The energy behemoth is expected to announce its fiscal Q3 earnings for 2025 after the market closes on Thursday, Oct. 23. Ahead of this event, analysts expect this energy technology company to report a profit of $0.62 per share, down 7.5% from $0.67 per share in the year-ago quarter. The company has a solid trajectory of consistently beating Wall Street’s earnings estimates in each of the last four quarters.

For fiscal 2025, analysts expect BKR to report a profit of $2.40 per share, up 2.1% from $2.35 per share in fiscal 2024. Its EPS is expected to further grow 9.6% year-over-year to $2.63 in fiscal 2026.

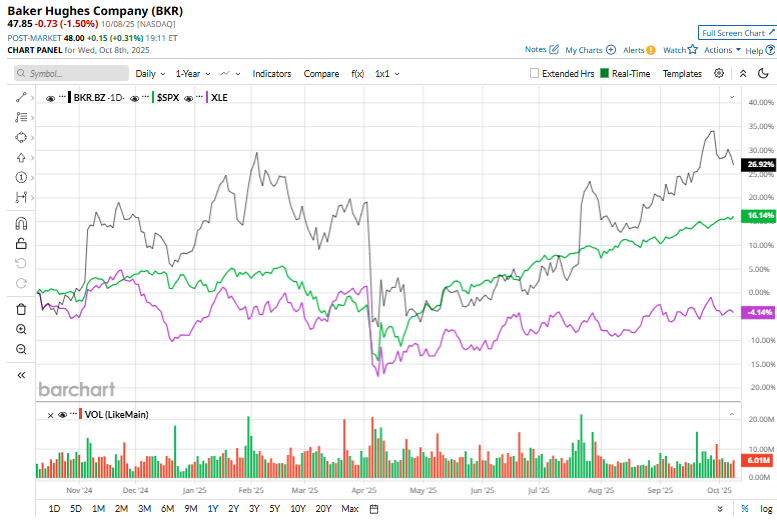

BKR shares have surged 27.7% over the past year, surpassing the S&P 500 Index's ($SPX) 17.4% rise and the Energy Select Sector SPDR Fund’s (XLE) 2.3% loss over the same time frame.

Baker Hughes has outperformed the broader market as it strengthens its position in the global energy transition, advancing technologies in carbon capture, hydrogen, and geothermal energy while sustaining solid growth in its traditional oilfield services business.

However, on Sept. 30, Baker Hughes fell over 3% as energy stocks declined following a more than 1% drop in WTI crude oil prices to a one-week low.

Wall Street analysts are highly optimistic about BKR’s stock, with a "Strong Buy" rating overall. Among 21 analysts covering the stock, 15 recommend "Strong Buy," two suggest “Moderate Buy,” and four indicate “Hold.” The mean price target for BKR is $52.25, which indicates a 9.2% potential upside from the current levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.