What to Expect From Enphase Energy’s Next Quarterly Earnings Report

/Enphase%20Energy%20Inc%20website%20on%20phone-by%20T_Schneider%20via%20Shutterstock.jpg)

Fremont, California-based Enphase Energy, Inc. (ENPH) is a leading global energy technology company specializing in solar microinverters, energy storage systems, and smart home energy solutions. With a market cap of $4.7 billion, its core innovation lies in its microinverter technology, which optimizes power generation and enhances the reliability of solar panels at the individual module level.

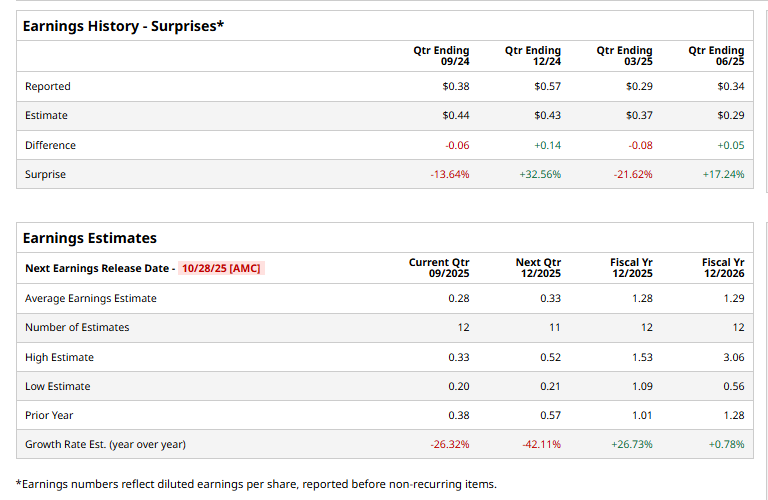

The company is expected to announce its fiscal Q3 earnings results on Tuesday, Oct. 28. Ahead of this event, analysts expect the energy company to report a profit of $0.28 per share, down 26.3% from $0.38 per share in the year-ago quarter. The company has surpassed Wall Street's bottom-line estimates in two of the past four quarters, while missing on two other occasions.

For fiscal 2025, analysts expect ENPH to report an EPS of $1.28, up 26.7% year over year from $1.01 in fiscal 2024.

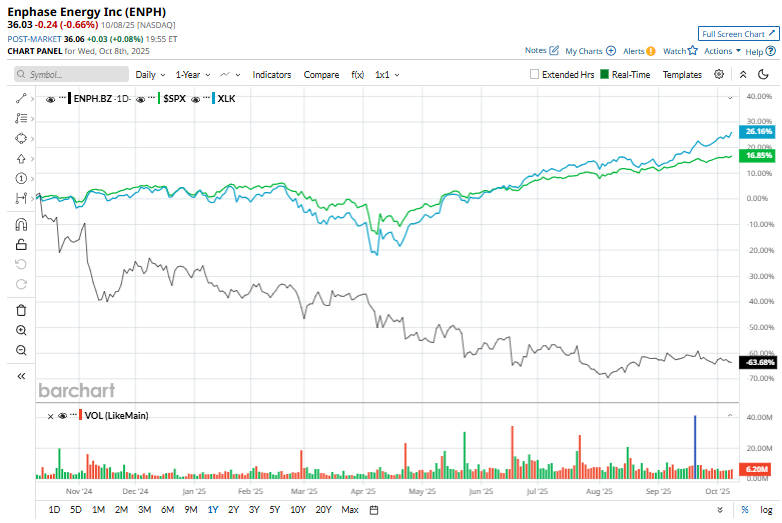

ENPH stock has declined 65.4% over the past 52 weeks, substantially underperforming the Technology Select Sector SPDR Fund’s (XLK) 27.5% surge and the S&P 500 Index’s ($SPX) 17.4% uptick during the same time frame.

On Oct. 2, ENPH shares rose 2% after the company announced a partnership with Essent, a major Dutch energy provider, to allow Enphase solar customers to add IQ® Batteries and join Essent’s Smart Steering program. The initiative helps households boost self-consumption, lower energy costs, and earn up to €122 in monthly compensation, while Essent manages battery usage to optimize home and grid efficiency.

Wall Street analysts are skeptical about ENPH’s stock, with a "Hold" rating overall. Among 31 analysts covering the stock, nine recommend "Strong Buy," one says “Moderate Buy,” 11 suggest “Hold,” one suggests “Moderate Sell,” and nine advise “Strong Sell.” ENPH’s average analyst price target of $41.80 indicates a potential upside of 16% from the current levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.