Seagate Technology’s Quarterly Earnings Preview: What You Need to Know

/Seagate%20Technology%20Holdings%20Plc%20logo%20magnified-by%20Casimiro%20PT%20via%20Shutterstock.jpg)

With a market cap of $47.9 billion, Seagate Technology Holdings plc (STX) is a leading global provider of data storage solutions, specializing in hard disk drives (HDDs), solid-state drives (SSDs), and data management systems. The Singapore-based company serves major markets, including cloud computing, enterprise data centers, and personal storage.

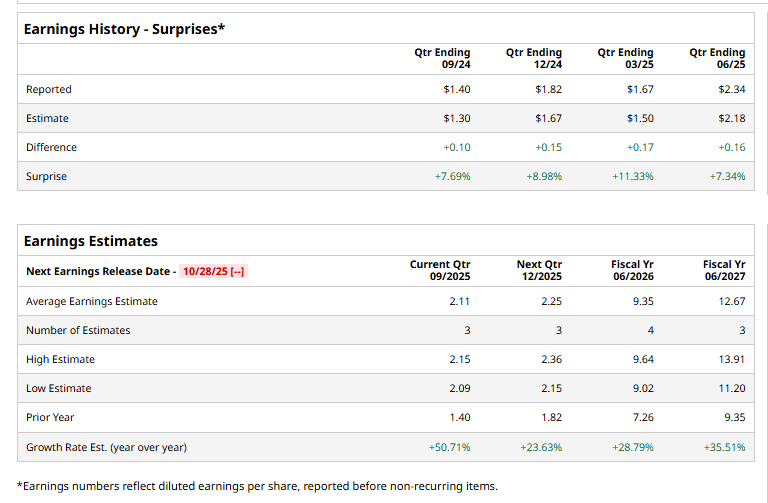

The data storage titan is slated to announce its fiscal Q1 2025 earnings results soon. Ahead of this event, analysts expect STX to report a profit of $2.11 per share, up 50.7% from $1.40 per share in the year-ago quarter. It has exceeded Wall Street's earnings expectations in all of the past four quarters.

For fiscal 2025, analysts expect the company to report EPS of $9.35, representing a 28.8% increase from $7.26 in fiscal 2024.

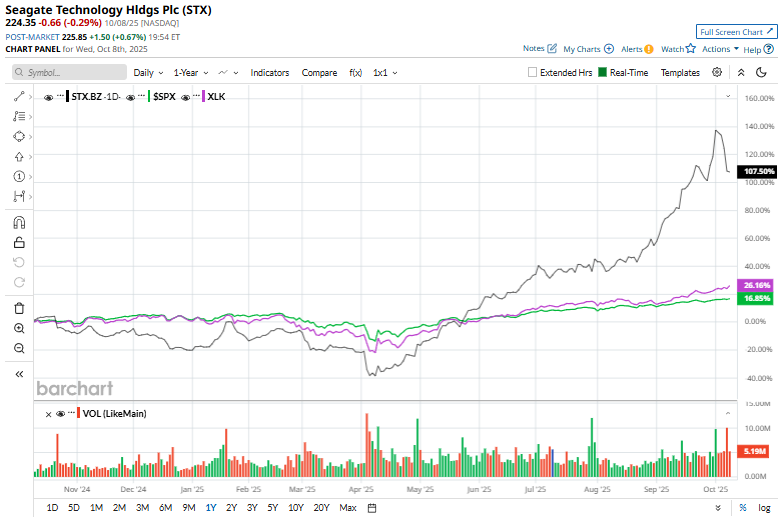

Shares of Seagate Technology have climbed 106.5% over the past 52 weeks, considerably outperforming the broader S&P 500 Index's ($SPX) 17.4% rise and the Technology Select Sector SPDR Fund's (XLK) 27.5% gain over the same period.

Seagate shares have outperformed the broader market over the past year due to its strong focus on high-capacity storage solutions and advanced technologies that cater to the rising data needs of the AI, cloud, and edge computing sectors.

On Sept. 29, Seagate shares rose 3.8% after multiple Wall Street analysts raised their price targets, citing strong AI-driven demand for hard disk drives. Morgan Stanley (MS) increased its target to $265, highlighting a prolonged demand cycle from cloud and AI infrastructure. Additionally, Rosenblatt Securities lifted its target to $250, expecting Seagate’s new HAMR-based drives to boost margins and sales.

Analysts' consensus view on Seagate Technology stock remains highly bullish, with an overall “Strong Buy” rating. Out of 22 analysts covering the stock, 16 recommend a "Strong Buy," one "Moderate Buy," four "Holds," and one "Strong Sell." As of writing, STX is trading above the average analyst price target of $196.80.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.